You’ll often hear people talking about how important keeping a good credit score is, but what exactly does that mean? In short, the higher your credit rating is, the better. This means banks will be more likely to loan to you at lower interest rates. The lower your credit rating, however, can make the process of borrowing money a lot tougher.

Your credit score is based upon your history of payments. Much like a school grade is given based upon your quality of work over a semester, a credit rating is determined by

how successful you’ve been to make payments in the past. There are two different credit reporting agencies in Canada: Equifax and Transunion. While each agency has their own criteria for determining scores, generally the breakdown includes:

- Payment history (35%) – From car payments to credit card bills, this number is determined by your track record for paying on time.

- Amounts owed (30%) – This takes your outstanding debts into account. Additionally, the figure is compared to the amount of credit you have available. Using the example of a credit card, if you were to consistently spend the maximum amount each month, this would negatively affect your score.

- Length of credit history (15%) – Good credit habits over a long period of time can help your score. This shows a proven track record.

- Types of credit used (10%) – Having a number of credit cards under your name can show that you’re a responsible borrower – IF you’re handling them correctly. The more diversity, the better. This shows potential creditors that you are able to manage multiple accounts.

- New credit (10%) – Every time that you open a new account, your score takes a temporary hit. For this reason, it’s vital to do so sparingly and to work on maintaining a good score with your existing accounts.

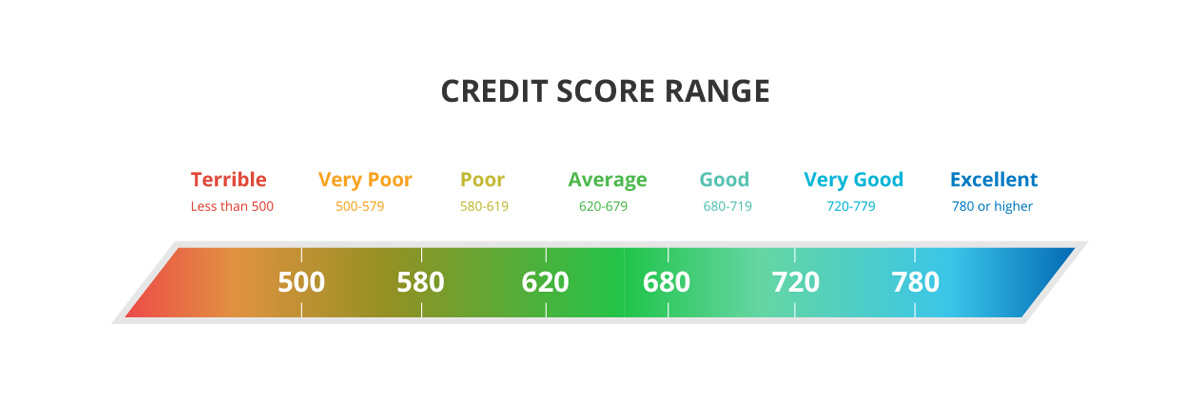

Based on this breakdown, a credit score is issued. As seen in this graphic below, the higher your score is the better your chances are of being approved for a mortgage. Those with 780 or higher typically always get approved. Mid scores between the low 700s and mid 600s generally have little trouble getting approved – in fact, the average credit score for Canadians is 696.

Scores that fall below 600, however, generally indicate that there is a risk associated to lending. For that reason, interest rates increase to compensate the associated uncertainty of regular payments. While the concept of credit scores can be overwhelming, there are many ways to work on improving your rating and to still get approved for a mortgage. If it is the case that you fall on the lower side of the scale, I encourage you to learn more about how I can help you deal with bad credit or reach out to me directly to discuss your situation.

Resource: https://loanscanada.ca/credit/what-your-credit-score-range-really-means